|

Phone: 917-533-2979 Email: info@smartbusinessfunder.com Learn More |

Since: February 2021 Since: February 2021 |

Stories

NYC Promotes its Own Online Business Loan Marketplace

March 17, 2024 There was so much demand for NYC’s experimental Small Business Opportunity Fund last year that it had to stop accepting applications after just 3 weeks. The program, however, ultimately enabled 1,046 businesses to collectively borrow $85 million at a low interest rate of only 4%. While the Mayor’s office has declared it a major success it is now encouraging anyone else seeking funds to use its relatively new online business loan marketplace called NYC Funds Finder.

There was so much demand for NYC’s experimental Small Business Opportunity Fund last year that it had to stop accepting applications after just 3 weeks. The program, however, ultimately enabled 1,046 businesses to collectively borrow $85 million at a low interest rate of only 4%. While the Mayor’s office has declared it a major success it is now encouraging anyone else seeking funds to use its relatively new online business loan marketplace called NYC Funds Finder.

Facilitated by Next Street, a b2b platform whose co-CEO Michael Roth is a former interim chief of the SBA, NYC Funds Finder promises to connect business owners with capital products that are “non-predatory and have been screened to ensure fair and transparent pricing and terms.”

An example of some of the lenders on the platform include Lendistry, Accompany Capital, and SmartBiz. APRs tend to range roughly from 7% to 19%.

“NYC Funds Finder serves New York City’s small businesses by aggregating funding options from many of [the NYC Department of] Small Business Services (SBS) and Next Street’s trusted partners,” said an official announcement that went out in September. “Additionally, the platform makes it easy for the business owner to connect with a free advisor if they need help navigating or applying for capital. This partnership with trusted SBS advisors is key for small businesses to access the best financing options for their business.”

Coincidentally, the SBA has also been pushing its own online business loan marketplace as of late. The SBA’s Lender Match tool has 1,000 SBA lenders and 257 community based lenders on its platform already.

BusinessFunding.com Sells for $44,000

February 12, 2024 The world of domain name investors called out a big sale that took place on GoDaddy over the weekend. The domain is businessfunding.com and it reportedly sold for $44,000, according to Namebio which tracks sales when data is available. The whois information does not reveal who the buyer is at this time.

The world of domain name investors called out a big sale that took place on GoDaddy over the weekend. The domain is businessfunding.com and it reportedly sold for $44,000, according to Namebio which tracks sales when data is available. The whois information does not reveal who the buyer is at this time.

Other potentially high value domain names in the small business finance industry include businessloans.com and smallbusinessloans.com, each of which are standalone businesses.

Meanwhile:

loans.com was sold for $3 million 24 years ago and today redirects to the homepage of Bank of America.

businesslenders.com belongs to Business Lenders, LLC, which has since ceased its lending operations.

businesslending.com redirects to a bio page for a big real estate broker.

merchantloan.com redirects to Circadian Funding’s website.

revenuebasedfinancing.com redirects to Lighter Capital’s website.

lenders.com is a page that hasn’t been set up yet.

lending.com doesn’t resolve.

How important is a domain name to a business? Important enough that a business can hardly afford to lose one. And did you hear about the first domain name to ever be used as loan collateral over the blockchain? It just happened recently!

Small Business Funding Companies Showcase Phenomenal Growth

August 15, 2023The annual Inc 5000 list is out again and with it some big reveals about who in the industry is taking off like a rocket. We’ve pulled out some of the relevant names for you below!

#30 – B2 Capital Solution Provider – Miami, FL – 10,446% growth over 3 years

#38 – Novo – Miami, FL – 9,906%

#76 – Byzfunder – New York, NY – 6,228%

#89 – Valiant Capital – Houston, TX – 5,223%

#157 – Ampla – New York, NY – 3,404%

#180 – LeasePoint Funding Group – Austin, TX – 2920%

#192 – Backd – Austin, TX – 2,819%

#269 – Percent – New York, NY – 2,087%

#1383 – eCapital – Aventura, FL – 422%

#1617 – North Mill Equipment Finance – Norwalk, CT- 354%

#1622 – Oakmont Capital Services – Westchester, PA – 346%

#1837 – Nav Technologies – Draper, UT – 305%

#1942 – Crestmont Capital – Irvine, CA – 289%

#2026 – 7 Figures Funding – American Fork, UT – 277%

#2593 – SBG Funding – New York, NY – 210%

#2929 – 1West – New York, NY – 179%

#2947 – ApplePie Capital – San Francisco, CA – 178%

#3145 – Channel – Minnetonka, MN – 164%

#3737 – Direct Funding Now, Irvine, CA – 128%

#4085 – Smarter Equipment Finance – Las Vegas, NV – 111%

#4094 – iAdvance Now. – Uniondale, NY – 111%

#4651 – Expansion Capital Group – Sioux Falls, SD – 87%

If we missed you, let us know, email info@debanked.com.

Don’t Count Out the Bank When it Comes to Small Business Lending

November 21, 2022 “So ideally, the best-case scenario for a business owner is always to try and get approved by a bank, it gives them more flexibility, you’re able to build that relationship with the bank,” said Juan Caban, Managing Partner at Financial Lynx.

“So ideally, the best-case scenario for a business owner is always to try and get approved by a bank, it gives them more flexibility, you’re able to build that relationship with the bank,” said Juan Caban, Managing Partner at Financial Lynx.

It’s an old adage that the bank is the best option, but given their historically tough criteria and reputation for sluggishness, the feasibility has long been a question. Caban, however, said that obtaining a bank line of credit is not as daunting as it sounds. Qualifying businesses (TIB 2+ years, 700+ FICO, and favorable industry) can obtain a pre-approval in 24 hours, approval in 7-10 days, and funding in another 2-3 weeks, making the entire process last about 3-4 weeks overall, according to Caban. And brokers can earn a one-time fee of up to 5% as well, he added.

“Bankers tend to be a little old fashioned oftentimes, now some of that’s changing in how they evolve,” said Patrick Reily, co-founder at Uplinq. “We’re dealing with some really interesting progressive banks in the last five years that are thinking about ‘how do we do better and how do we change things,’ but the reality is that they tend to move more slowly.”

Reily’s company, Uplinq, empowers lenders like banks, credit unions, or other financial institutions to approve and manage risks on loans they would have otherwise declined.

“Some of the companies we work for, they’re able to increase the number of people they lend to by 5 to 15 fold,” Reily said. “Think about that. That’s a huge difference.”

Technology, it appears, is widening the approval window, which means business owners shouldn’t count out options they previously thought impossible.

Caban of Financial Lynx, echoed same, explaining that business owners should explore all potential avenues.

“We pride ourselves in knowing the trends and products in banking and can be a great asset for Brokers/ISOs,” Caban said.

“I think it’s smart always to look broadly and understand what your options are, who is best capable to serve you,” said Reily.

Joe Camberato Named CEO of National Business Capital & Services

November 9, 2020 November 9, 2020, Bohemia, NY – National Business Capital & Services, the nation’s leading FinTech lending marketplace which streamlines the application and approval process for small business owners, today named Joe Camberato CEO. He succeeds James Webster, who has exited the company to pursue new endeavors.

November 9, 2020, Bohemia, NY – National Business Capital & Services, the nation’s leading FinTech lending marketplace which streamlines the application and approval process for small business owners, today named Joe Camberato CEO. He succeeds James Webster, who has exited the company to pursue new endeavors.

The announcement comes as the COVID-19 crisis has crippled small businesses across America. Not only are business owners challenged with the overwhelming stress of meeting near-term financing demands simply to survive, but they are also tasked with re-imagining how to best position their businesses for growth in the post pandemic ‘new normal’.

“Through booming and challenging times, National’s priority has always been to serve as the go-to source for small businesses to find competitive financing options, revenue-generating services and consultative support to help them at every step of their growth journey,” said Camberato.

“When it comes to small business loan approvals, banks are highly conservative, tending to lend an umbrella when the sun is shining. With COVID-19, the sun is not shining. We recognize how crucial it is to provide access to competitive financing options to help businesses survive, but they also desperately need help to rebuild and grow.”

In a recent survey of small to mid-sized businesses by CBIZ, over half (51%) of respondents reported a significant decrease in sales due to the pandemic. Smaller businesses have been disproportionately impacted, with nearly half of businesses with 1-4 employees reporting a significant or severe impact, and 37% of businesses with 20-49 employees noting a significant or severe impact.

In taking reins as CEO, Camberato is steadfastly committed to National’s vision to Innovate the Way Entrepreneurs Grow by offering essential resources beyond just financing. His plans include enhanced business growth consulting and coaching offerings, which he anticipates will be a dire post-pandemic need, but is currently a significant gap across the competitive landscape.

In taking reins as CEO, Camberato is steadfastly committed to National’s vision to Innovate the Way Entrepreneurs Grow by offering essential resources beyond just financing. His plans include enhanced business growth consulting and coaching offerings, which he anticipates will be a dire post-pandemic need, but is currently a significant gap across the competitive landscape.

Michael Gerber, a mega bestseller who was named “The World’s #1 Small Business Guru” by Inc. Magazine, commended National’s efforts toward empowering small business owners by providing streamlined access to capital, among other game-changing resources.

“I’ve admired Joe since the day we met. He shares my mission to transform the state of small business and has unmatched knowledge of small business lending practices. His personal success building a scalable business, and passion for helping entrepreneurs and small business owners invest their efforts in the right areas to create sustainable, growth-oriented companies have been invaluable as we work together to co-author our new book,” says Gerber.

Gerber is currently collaborating with Camberato to write “The E-Myth Money Book”, which will educate small business owners about the various avenues they can take to obtain and successfully utilize small business financing while growing their businesses.

As one of National’s original founders and previous President, Camberato spearheaded significant technological innovations, implemented process enhancements, and helped build an amazing company culture on his mission to simplify the previously laborious business financing process for small business owners, securing over $1 billion in financing in the process.

Now, business owners can apply in one simple place and securely connect their bank accounts to receive tailored financing options in minutes, with funding following in as little as a few hours.

Beyond streamlined technology and processes, Camberato credits National’s success to its award-winning team and applauds their role in helping business owners get back to business amid the pandemic.

“By taking the time to understand business owner challenges or opportunities, our amazing team has established the National brand as a trusted source of capital and counsel. I couldn’t be prouder of my team’s dedication to helping small business owners, but also for their significant role in helping our clients overcome the COVID-19 crisis and get back to business. They rally behind our mission to be the trusted resource business owners turn to for financing, revenue-generating services, and business coaching and will play a pivotal role as we add new offerings to help businesses not only survive but thrive and grow.”

Camberato regularly shares his insights about FinTech lending, access to capital and small business growth strategies through his seat on the Forbes Finance Council and his YouTube channel, GrowByJoe. He is also an active member of the Young Presidents Organization (YPO) and is actively involved in giving back, locally and nationally.

ABOUT NATIONAL BUSINESS CAPITAL & SERVICES

National Business Capital & Services is the #1 FinTech marketplace offering small business loans and services. Harnessing the power of smart technology and even smarter people, we’ve streamlined the approval process to secure over $1 billion in financing for small business owners to date.

Our expert Business Financing Advisors work within our 75+ Lender Marketplace in real time to give you easy access to the best low-interest SBA loans, short and long-term loans and business lines of credit, as well as a full suite of revenue-driving business services. We strengthen local communities one small business loan at a time. For every deal we fund, we donate 10 meals to Feeding America!

CONTACT:

Matt Carrigan

press@National.biz | www.National.biz

National Business Capital & Services

1 Corporate Dr, Suite 202, Bohemia NY 11716

Toll Free: (877) 482-3008 | Fax: (631) 446-6016

SOURCE National Business Capital & Services

Canadian Small Businesses Face Tough Challenges As Government Passes Over Fintech

April 8, 2020 This week the Canadian government announced its coronavirus economic relief plans. Among them are two initiatives that aim to assist small businesses: the Canada Emergency Response Benefit (CERB) and Canada Emergency Business Account (CEBA).

This week the Canadian government announced its coronavirus economic relief plans. Among them are two initiatives that aim to assist small businesses: the Canada Emergency Response Benefit (CERB) and Canada Emergency Business Account (CEBA).

The first of these is a wage subsidy that will cover up to 75% of a company’s payroll. The hope being that this will postpone the overcrowding and clogging of the Canadian unemployment benefits system, known as employment insurance. However this program appears to appeal to only certain types of businesses. With subcontractors not qualifying as part of payroll, there is the fear that CERB could leave many small businesses and startups that rely on freelancers unprotected. As well as this, there is a requirement that the company’s most recent month of revenue be at least 30% less than what it was at the same time the previous year. This specification again acting as an obstacle to startups and high growth businesses.

The second is a loan program that is capped at CAN$40,000 with 0% interest for the first two and a half years, and then 5% annual interest beginning January 1, 2023. There will be an opportunity for the remainder of the loan to be forgiven if the business has repaid 75% by December 31, 2022.

According to Smarter Loans’ Vlad Sherbatov, the situation in Canada mirrors what is happening in the US with regards to PPP. “There are very little details available about how people are going to apply to get the funds,” the President and Co-Founder explained. “Nobody knows what’s actually happening and nobody knows when business owners can actually anticipate to receive any funding.”

Expressing frustration that the Canadian government chose to ignore non-bank lenders in favor of allowing Canadian banks like BMO, RBC, and TD to distribute the funds, Sherbatov noted that it is the lenders who have the technology and processes to speedily disperse capital. “We did a survey that said almost 50% of business owners said they would shut down in less that four weeks without additional help … so it’s not that it’s just fine that there is help available, it’s how fast can [business owners] get the help, because every day that goes by makes the situation worse.”

Expressing frustration that the Canadian government chose to ignore non-bank lenders in favor of allowing Canadian banks like BMO, RBC, and TD to distribute the funds, Sherbatov noted that it is the lenders who have the technology and processes to speedily disperse capital. “We did a survey that said almost 50% of business owners said they would shut down in less that four weeks without additional help … so it’s not that it’s just fine that there is help available, it’s how fast can [business owners] get the help, because every day that goes by makes the situation worse.”

Speaking to Kevin Clark, President of Lendified, he echoed Sherbatov’s concern.

“It’s all good that the government is making these decisions, but the capital has to move and the programs have to be in effect. So announcing these things is one thing, actually practicing them and executing them is another. There’s a time lag that could potentially put companies out of business and so, for us, it’s about trying to connect with a lot of these borrowers to say, ‘What can we do to help you with payments?’ But at the same time, we don’t want deferments for a long period of time because then our revenue base is challenged. So the fintech lenders all have significant challenges at hand, because defaults that move from within the normal course of between 5 and 10%, say now to between 15 and 25%, or even higher, are significant challenges for the operations of our business.”

Also a member of the Canadian Lenders Association, Clark is involved in the CLA covid-19 working group that was launched in March. Formed with the intention to assist the government’s approach to capital distribution, Clark was disappointed with the government’s decision to exclude non-bank lenders after the group reached out to both the Ministry of Finance and the Business Development Corporation of Canada. And with no government funding operation to assist, Clark, like many lenders in Canada, is turning toward his existing customers, hoping to keep their heads above water.

“What we’re all doing independently is trying to work with our customers to give them guidance on what is going on in Ottawa. And so most of us have made website adjustments to give some education to interested parties on what’s available in terms of subsidy. We’re trying to provide support to our customers through deferments and so forth, just as every lending institution is doing these days. It’s just that I think it’s harder for us and smaller firms that don’t have the margin and the wherewithal to withstand any sort of significant timeline in this situation. So it’s a little bit of week by week for us, trying to manage our own costs and so forth and keep our customer bases as happy and healthy as we can.”

The FTC Wants To Police Small Business Finance

October 22, 2019 On May 23, the Federal Trade Commission launched an investigation into unfair or deceptive practices in the small business financing industry, including by merchant cash advance providers.

On May 23, the Federal Trade Commission launched an investigation into unfair or deceptive practices in the small business financing industry, including by merchant cash advance providers.

The agency is looking into, among other things, whether both financial technology companies and merchant cash advance firms are making misrepresentations in their marketing and advertising to small businesses, whether they employ brokers and lead-generators who make false and misleading claims, and whether they engage in legal chicanery and misconduct in structuring contracts and debt-servicing.

Evan Zullow, senior attorney at the FTC’s consumer protection division, told deBanked that the FTC is, moreover, investigating whether fintechs and MCAs employ “problematic,” “egregious” and “abusive” tactics in collecting debts. He cited such bullying actions as “making false threats of the consequences of not paying a debt,” as well as pressuring debtors with warnings that they could face jail time, that authorities would be notified of their “criminal” behavior, contacting third-parties like employers, colleagues, or family members, and even issuing physical threats.

“Broadly,” Zullow said in a telephone interview, “our work and authority reaches the full life cycle of the financing arrangement.” He added: “We’re looking closely at the conduct (of firms) in this industry and, if there’s unlawful conduct, we’ll take law enforcement action.”

Zullow declined to identify any targets of the FTC inquiry. “I can’t comment on nonpublic investigative work,” he said.

The FTC investigation is one of several regulatory, legislative and law enforcement actions facing the merchant cash advance industry, which was triggered by a Bloomberg exposé last winter alleging sharp practices by some MCA firms.

The FTC investigation is one of several regulatory, legislative and law enforcement actions facing the merchant cash advance industry, which was triggered by a Bloomberg exposé last winter alleging sharp practices by some MCA firms.

The Bloomberg series told of high-cost financings, of MCA firms’ draining debtors’ bank accounts, and of controversial collections practices in which debtors signed contracts that included “confessions of judgment.”

The FTC long ago outlawed the use of COJs in consumer loan contracts and several states have banned their use in commercial transactions. In September, Governor Andrew Cuomo signed legislation prohibiting the use of COJs in New York State courts for out-of-state residents. And there is a bipartisan bill pending in the U.S. Senate authored by Florida Republican Marco Rubio and Ohio Democrat Sherrod Brown to outlaw COJs nationwide.

Mark Dabertin, a senior attorney at Pepper Hamilton, described the FTC’s investigation of small business financing as a “significant development.” But he also said that the agency’s “expansive reading of the FTC Act arguably presents the bigger news.” Writing in a legal memorandum to clients, Dabertin added: “It opens the door to introducing federal consumer protection laws into all manner of business-to-business conduct.”

FTC attorney Zullow told deBanked, “We don’t think it’s new or that we’re in uncharted waters.”

The FTC inquiry into alternative small business financing is not the only investigation into the MCA industry. Citing unnamed sources, The Washington Post reported in June that the Manhattan district attorney is pursuing a criminal investigation of “a group of cash advance executives” and that the New York State attorney general’s office is conducting a separate civil probe.

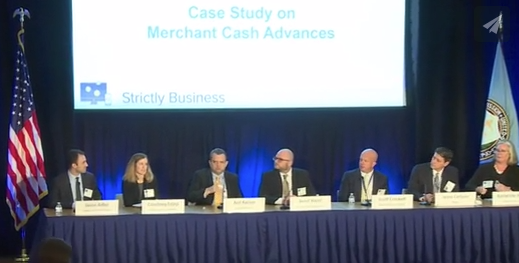

The FTC’s investigation follows hard on the heels of a May 8 forum on small business financing. Labeled “Strictly Business,” the proceedings commenced with a brief address by FTC Commissioner Rohit Chopra, who paid homage to the vital role that small business plays in the U.S. economy. “Hard work and the creativity of entrepreneurs and new small businesses helped us grow,” he said.

But he expressed concern that entrepreneurship and small business formation in the U.S. was in decline. According to census data analyzed by the Kaufmann Foundation and the Brookings Institution, the commissioner noted, the number of new companies as a share of U.S. businesses has declined by 44 percent from 1978 to 2012.

“It’s getting harder and harder for entrepreneurs to launch new businesses,” Chopra declared. “Since the 1980s, new business formation began its long steady decline. A decade ago births of new firms started to be eclipsed by deaths of firms.”

Chopra singled out one-sided, unjust contracts as a particularly concerning phenomenon. “One of the most powerful weapons wielded by firms over new businesses is the take-it-or-leave-it contract,” he said, adding: “Contracts are ways that we put promises on paper. When it comes to commerce, arm’s length dealing codified through contracts is a prerequisite for prosperity. “But when a market structure requires small businesses to be dependent on a small set of dominant firms — or firms that don’t engage in scrupulous business practices — these incumbents can impose contract terms that cement dominance, extract rents, and make it harder for new businesses to emerge and thrive.”

As the panel discussions unfolded, representatives of the financial technology industry (Kabbage, Square Capital and the Electronic Transactions Association) as well as executives in the merchant cash advance industry (Kapitus, Everest Business Financing, and United Capital Source) sought to emphasize the beneficial role that alternative commercial financiers were playing in fostering the growth of small businesses by filling a void left by banks.

The fintechs went first. In general, they stressed the speed and convenience of their loans and lines of credit, and the pioneering innovations in technology that allowed them to do deeper dives into companies seeking credit, and to tailor their products to the borrower’s needs. Panelists cited the “SMART Box” devised by Kabbage and OnDeck as examples of transparency. (Accompanying those companies’ loan offers, the SMART Box is modeled on the uniform terms contained in credit card offerings, which are mandated by the Truth in Lending Act. TILA does not pertain to commercial debt transactions.)

Sam Taussig, head of global policy at Kabbage, explained that his company typically provides loans to borrowers with five to seven employees — “truly Main Street American small businesses” — that are seeking out “project-based financing” or “working capital.”

Sam Taussig, head of global policy at Kabbage, explained that his company typically provides loans to borrowers with five to seven employees — “truly Main Street American small businesses” — that are seeking out “project-based financing” or “working capital.”

“The average small business according to our research only has about 27 days of cash flow on hand,” Taussig told the fintech panel, FTC moderators and audience members. “So if you as a small business owner need to seize an opportunity to expand your revenue or (have) a one-off event — such as the freezer in your ice cream store breaks — it’s very difficult to access that capital quickly to get back to business or grow your business.”

Taussig contrasted the purpose of a commercial loan with consumer loans taken out to consolidate existing debt or purchase a consumer product that’s “a depreciating asset.” Fintechs, which typically supply lightning-quick loans to entrepreneurs to purchase equipment, meet payrolls, or build inventory, should be judged by a different standard.

A florist needs to purchase roses and carnations for Mother’s Day, an ice-cream store must replenish inventory over the summer, an Irish pub has to stock up on beer and add bartenders at St. Patrick’s Day.

The session was a snapshot of not just the fintech industry but of the state of small business. Lewis Goodwin, the head of banking services at Square Capital, noted that small businesses account for 48% of the U.S. workforce. Yet, he said, Square’s surveys show that 70% of them “are not able to get what they want” when they seek financing.

Square, he said, has made 700,000 loans for $4.5 billion in just the past few years, the platform’s average loan is between $6,000 and $7,000, and it never charges borrowers more than 15% of a business’s daily receipts. The No. 1 alternative for small businesses in need of capital is “friends and family,” Goodwin said, “and that’s a tough bank to go back to.”

Panelist Gwendy Brown, vice-president of research and policy at the Opportunity Fund, a non-profit microfinance organization, provided the fintechs with their most rocky moment when she declared that small businesses turning up at her fund were typically paying an annual percentage rate of 94 percent for fintech loans. And while most small business owners were knowledgeable about their businesses — the florists “know flowers in and out,” for example — they are often bewildered by the “landscape” of financial product offerings.

Panelist Gwendy Brown, vice-president of research and policy at the Opportunity Fund, a non-profit microfinance organization, provided the fintechs with their most rocky moment when she declared that small businesses turning up at her fund were typically paying an annual percentage rate of 94 percent for fintech loans. And while most small business owners were knowledgeable about their businesses — the florists “know flowers in and out,” for example — they are often bewildered by the “landscape” of financial product offerings.

“Sophistication as a business owner,” Brown said, “does not necessarily equate into sophistication in being able to assess finance options.”

Panelist Claire Kramer Mills, vice-president of the Federal Reserve Bank of New York, reported that the country’s banks have made a dramatic exit from small business lending over the past ten years. A graphic would show that bank loans of more than $1 million have risen dramatically over the past decade but, she said, “When you look at the small loans, they’ve remained relatively flat and are not back to pre-crisis levels.”

Mills also said that 50% of small businesses in the Federal Reserve’s surveys “tell us that they have a funding shortfall of some sort or another. It’s more stark when you look at women-owned business, black or African-American owned businesses, and Latino-owned businesses.”

On the merchant cash advance panel there was less opportunity to dazzle the regulators and audience members with accounts of state-of-the-art technology and the ability to aggregate mountains of data to make online loans in as few as seven minutes, as Kabbage’s Taussig noted the fintech is wont to do.

Instead, industry panelists endeavored to explain to an audience — which included skeptical regulators, journalists, lawyers and critics — the precarious, high-risk nature of an MCA or factoring product, how it differs from a loan, and the upside to a merchant opting for a cash advance. (To their credit, one attendee told deBanked, the audience also included members of the MCA industry interested in compliance with federal law.)

Instead, industry panelists endeavored to explain to an audience — which included skeptical regulators, journalists, lawyers and critics — the precarious, high-risk nature of an MCA or factoring product, how it differs from a loan, and the upside to a merchant opting for a cash advance. (To their credit, one attendee told deBanked, the audience also included members of the MCA industry interested in compliance with federal law.)

A merchant cash advance is “a purchase of future receipts,” Kate Fisher, an attorney at Hudson Cook in Baltimore, explained. “The business promises to deliver a percentage of its revenue only to the extent as that revenue is created. If sales go down,” she explained, “then the business has a contractual right to pay less. If sales go up, the business may have to pay more.”

As for the major difference between a loan and a merchant cash advance: the borrower promises to repay the lender for the loan, Fisher noted, but for a cash advance “there’s no absolute obligation to repay.”

Scott Crockett, chief executive at Everest Business Funding, related two anecdotes, both involving cash advances to seasonal businesses. In the first instance, a summer resort in Georgia relied on Everest’s cash advances to tide it over during the off-season.

When the resort owner didn’t call back after two seasonal advances, Crockett said, Everest wanted to know the reason. The answer? The resort had been sold to Marriott Corporation. Thanking Everest, Crockett said, the former resort-owners reported that without the MCA, he would likely have sold off a share of his business to a private equity fund or an investor.

By providing a cash advance Everest acted “more like a temporary equity partner,” Crockett remarked.

In the second instance, a restaurant in the Florida Keys that relied on a cash advance from Everest to get through the slow summer season was destroyed by Hurricane Irma. “Thank God no one was hurt,” Crockett said, “but the business owner didn’t owe us anything. We had purchased future revenues that never materialized.”

The outsized risk borne by the MCA industry is not confined entirely to the firm making the advance, asserted Jared Weitz, chief executive at United Capital Service, a consultancy and broker based in Great Neck, N.Y. It also extends to the broker. Weitz reported that a big difference between the MCA industry and other funding sources, such as a bank loan backed by the Small Business Administration, is that ”you are responsible to give that commission back if that merchant does not perform or goes into an actual default up to 90 days in.

“I think that’s important,” Weitz added, “because on (both) the broker side and on the funding side, we really are taking a ride with the merchant to make sure that the business succeeds.”

FTC’s panel moderators prodded the MCA firms to describe a typical factor rate. Jesse Carlson, senior vice-president and general counsel at Kapitus, asserted that the factor rate can vary, but did not provide a rate.

FTC’s panel moderators prodded the MCA firms to describe a typical factor rate. Jesse Carlson, senior vice-president and general counsel at Kapitus, asserted that the factor rate can vary, but did not provide a rate.

“Our average financing is approximately $50,000, it’s approximately 11-12 months,” he said. “On a $50,000 funding we would be purchasing $65,000 of future revenue of that business.”

The FTC moderator asked how that financing arrangement compared with a “typical” annual percentage rate for a small business financing loan and whether businesses “understand the difference.”

Carlson replied: “There is no interest rate and there is no APR. There is no set repayment period, so there is no term.” He added: “We provide (the) total cost in a very clear disclosure on the first page of all of our contracts.”

Ami Kassar, founder and chief executive of Multifunding, a loan broker that does 70% of its work with the Small Business Administration, emerged as the panelist most critical of the MCA industry. If a small business owner takes an advance of $50,000, Kassar said, the advance is “often quoted as a factor rate of 20%. The merchant thinks about that as a 20% rate. But on a six-month payback, it’s closer to 60-65%.”

He asserted that small businesses would do better to borrow the same amount of money using an SBA loan, pay 8 1/4 percent and take 10 years to pay back. It would take more effort and the wait might be longer, but “the impact on their cash flow is dramatic” — $600 per month versus $600 a day, he said — “compared to some of these other solutions.”

Kassar warned about “enticing” offers from MCA firms on the Internet, particularly for a business owner in a bind. “If you jump on that train and take a short-term amortization, oftentimes the cash flow pressure that creates forces you into a cycle of short-term renewals. As your situation gets tougher and tougher, you get into situations of stacking and stacking.”

On a final panel on, among other matters, whether there is uniformity in the commercial funding business, panelists described a massive muddle of financial products.

Barbara Lipman: project manager in the division of community affairs with the Federal Reserve Board of Governors, said that the central bank rounded up small businesses to do some mystery shopping. The cohort — small businesses that employ fewer than 20 employees and had less than $2 million in revenues — pretended to shop for credit online.

As they sought out information about costs and terms and what the application process was like, she said, “They’re telling us that it’s very difficult to find even some basic information. Some of the lenders are very explicit about costs and fees. Others however require a visitor to go to the website to enter business and personal information before finding even the basics about the products.” That experience, Lipman said, was “problematic.”

She also said that, once they were identified as prospective borrowers on the Internet, the Fed’s shoppers were barraged with a ceaseless spate of online credit offers.

John Arensmeyer, chief executive at Small Business Majority, an advocacy organization, called for greater consistency and transparency in the marketplace. “We hear all the time, ‘Gee, why do we need to worry about this? These are business people,’” he said. “The reality is that unless a business is large enough to have a controller or head of accounting, they are no more sophisticated than the average consumer.

“Even about the question of whether a merchant cash advance is a loan or not,” Arensmeyer added. “To the average small business owner everything is a loan. These legal distinctions are meaningless. It’s pretty much the Wild West.”

In the aftermath of the forum, the question now is: What is the FTC likely to do?

In the aftermath of the forum, the question now is: What is the FTC likely to do?

Zullow, the FTC attorney, referred deBanked to several recent cases — including actions against Avant and SoFi — in which the agency sanctioned online lenders that engaged in unfair or deceptive practices, or misrepresented their products to consumers.

These included a $3.85 million settlement in April, 2019, with Avant, an online lending company. The FTC had charged that the fintech had made “unauthorized charges on consumers’ accounts” and “unlawfully required consumers to consent to automatic payments from their bank accounts,” the agency said in a statement.

In the settlement with SoFi, the FTC alleged that the online lender, “made prominent false statements about loan refinancing savings in television, print, and internet advertisements.” Under the final order, “SoFi is prohibited from misrepresenting to consumers how much money consumers will save,” according to an FTC press release.

But these are traditional actions against consumer lenders. A more relevant FTC action, says Pepper Hamilton attorney Dabertin, was the FTC’s “Operation Main Street,” a major enforcement action taken in July, 2018 when the agency joined forces with a dozen law enforcement partners to bring civil and criminal charges against 24 alleged scam artists charged with bilking U.S. small businesses for more than $290 million.

In the multi-pronged campaign, which Zullow also cited, the FTC collaborated with two U.S. attorneys’ offices, the attorneys general of eight states, the U.S. Postal Inspection Service, and the Better Business Bureau. According to the FTC, the strike force took action against six types of fraudulent schemes, including:

- Unordered merchandise scams in which the defendants charged consumers for toner, light bulbs, cleaner and other office supplies that they never ordered;

- Imposter scams in which the defendants use deceptive tactics, such as claiming an affiliation with a government or private entity, to trick consumers into paying for corporate materials, filings, registrations, or fees;

- Scams involving unsolicited faxes or robocalls offering business loans and vacation packages.

If there remains any question about whether the FTC believes itself constrained from acting on behalf of small businesses as well as consumers, consider the closing remarks at the May forum made by Andrew Smith, director of the agency’s bureau of consumer protection.

“(O)ur organic statute, the FTC Act, allows us to address unfair and deceptive practices even with respect to businesses,” Smith declared, “And I want to make clear that we believe strongly in the importance of small businesses to the economy, the importance of loans and financing to the economy.

Smith asserted that the agency could be casting a wide net. “The FTC Act gives us broad authority to stop deceptive and unfair practices by nonbank lenders, marketers, brokers, ISOs, servicers, lead generators and collectors.”

As fintechs and MCAs, in particular, await forthcoming actions by the commission, their membership should take pains to comport themselves ethically and responsibly, counsels Hudson Cook attorney Fisher. “I don’t think businesses should be nervous,” she says, “but they should be motivated to improve compliance with the law.”

She recommends that companies make certain that they have a robust vendor-management policy in place, and that they review contracts with ISOs. Companies should also ensure that they have the ability to audit ISOs and monitor any complaints. “Take them seriously and respond,” Fisher says.

Companies would also do well to review advertising on their websites to ascertain that claims are not deceptive, and see to it that customer service and collections are “done in a way that is fair and not deceptive,” she says, adding of the FTC investigation: “This is a wake-up call.”

Consultative Selling in Small Business Finance

October 16, 2019

It’s nearly impossible to teach fiscal responsibility to most consumers, according to researchers at universities and nonprofit agencies. But alternative small-business funders and brokers often manage to steer clients toward financial prudence, and imparting pecuniary knowledge can become part of a consultative approach to selling.

It’s nearly impossible to teach fiscal responsibility to most consumers, according to researchers at universities and nonprofit agencies. But alternative small-business funders and brokers often manage to steer clients toward financial prudence, and imparting pecuniary knowledge can become part of a consultative approach to selling.

Still, nobody says it’s easy to convince the public or merchants to handle cash, credit and debt wisely and responsibly. Consider the consumer research cited by Mariel Beasley, principal at the Center for Advanced Hindsight at Duke University and co-director of the Common Cents Lab, which works to improve the financial behavior of low- and moderate-income households.

“For the last 30 years in the U.S. there has been a huge emphasis on increasing financial education, financial literacy,” Beasley says. But it hasn’t really worked. “Content-based financial education classes only accounted for .1 percent variation in financial behavior,” she continues. “We like to joke that it’s not zero but it’s very, very close.” And that’s the average. Online and classroom financial education influences lower-income people even less.

The problem stems from trying to teach financial responsibility too late in life, says Noah Grayson, president and founder of Norwalk, Conn.-based South End Capital. He advocates introducing young people to finance at the same time they’re learning history, algebra and other standard subjects in school.

Yet Grayson and others contend that it’s never too late for motivated entrepreneurs to pick up the basics. Even novice small-business owners tend to possess a little more financial acumen than the average person, they say. That makes entrepreneurs easier to teach than the general public but still in need of coaching in the basics of handling money.

Take the example of a shopkeeper who grabs an offer of $50,000 with no idea how he’ll use the funds to grow the business or how he’ll pay the money back, suggests Cheryl Tibbs, general manager of One Stop Commercial Capital, Douglasville, Ga. “The easy access to credit blinds a lot of merchants,” she notes.

Entrepreneurs often make bad decisions simply because they don’t have a background in business, according to Jared Weitz, CEO of New York based United Capital Source. “Many of the people who come to us are trying their hardest,” he observes.

Entrepreneurs often make bad decisions simply because they don’t have a background in business, according to Jared Weitz, CEO of New York based United Capital Source. “Many of the people who come to us are trying their hardest,” he observes.

Weitz offers the example of his own close relative who’s a veterinarian. That profession attracts some of the brainiest high-school valedictorians but doesn’t mean they know business. “He’s the best doctor ever and he’s not a great businessman because he doesn’t think about those things first. What he thinks about is helping people. That’s why he got into his profession.”

Entrepreneurs often devote themselves to a vision that isn’t businesses-oriented. “They start a business because they have a great idea or a great product, and that’s what excites them,” Grayson says. “They jump in with both feet and don’t think much about the business side.” The business side isn’t as much fun.

Merchants also attend to so many aspects of an enterprise—everything from sales, production and distribution to hiring, payroll and training—that they can’t afford to devote too much time to any single facet, notes Joe Fiorella, principal at Kansas City, Mo.-based Central Funding. Business owners respond to what’s most urgent, not necessarily what’s most important.

For whatever reason, some business owners spiral downward into financial ruin, bouncing checks, stacking merchant cash advances and continually seeking yet another merchant cash advance to bail them out of a precarious situation, says Jeremy Brown, chairman of Bethesda, Md.-based Rapid Advance.

Weitz advises sitting down with those clients and coming to an understanding of the situation. In some cases, enough cash might be coming in but the incoming autopayments aren’t timed to cover the outgoing autopayments, he says by way of example.

Informing clients of such problems makes a demonstrable difference. “We can see that it works because we have clients renewing with us,” says Weitz. “We’re able to swim them upstream to different products” as their finances gradually improve, he says.

The products in that stream begin with relatively higher-cost vehicles like merchant cash advances and proceed to other less-expensive instruments with better terms, says Brown. Those include term loans, Small Business Administration loans, equipment leasing, receivables factoring and, ultimately the goal for any well-capitalized small business—a relationship with the local bank.

Failing to consider those options and instead simply abetting stackers to make a quick buck can give the industry a “black eye,” and it benefits none of the parties involved, Tibbs observes. But merchants deserve as much blame as funders and brokers, she maintains.

Prospective clients who stack MCAs, don’t care about their credit rating and simply want to staunch their financial bleeding probably account for 35 percent to 40 percent of the applicants Tibbs encounters, she says.

Just the same, alt-funders continue to urge clients to hire accountants, consult attorneys, employ helpful software, shore up credit ratings, keep tabs on cash flow, calculate margins, improve distribution chains and outline plans for growth. It’s what helps the industry rise above the “get-money quick” image that it’s outgrowing, Weitz, says. Many funders and brokers consider providing financial advice an essential aspect of consultative selling. It’s an approach that begins with making sure applicants understand the debt they’re taking on, the terms of the payback and how their businesses will benefit from the influx of capital. It continues with a commitment to helping clients not just with funding but also with other types of business consultation.

“It’s not so much selling as building a rapport with clients—serving as a strategic advisor or financial resource for them, identifying their needs and directing them to the right loan product to meet those needs,” says Grayson. “They should feel they can call you about anything specific to their business, not just their loan requests.” He also cautions against providing information the client will not absorb or will find offensive.

Justin Bakes, CEO of Boston-based Forward Financing also advocates consultative selling. “It’s all about questions and getting information on what’s driving the business owner,” he says. “It’s a process.”

Consultative sales hinges on knowing the customer, agrees Jason Solomon, Forward Financing vice president of sales. “Businesses are never similar in the mind of the business owner,” he notes. “To effectively structure a program best-suited to the merchant’s long-time business needs and set a proper path forward to better and better financial products, you need to know who the business owner is and what his long term goals are.”

“It’s taking an approach of actually being a consultant as opposed to a $7 an hour order taker,” Tibbs says of consultative selling. “I like to teach new reps to think of it as if you were a doctor. Doctors ask questions to arrive at a final diagnosis. So if you’re asking your prospective customer questions about their business, about their cash flow, about their intentions of how they’re planning to get back on track.”

Learning about the clients’ business helps brokers recommend the least-expensive funding instrument, Tibbs says. “I really hate to see someone with a 700 credit score come in to get a merchant cash advance,” she maintains. The consultative approach requires knowing the funding products, knowing how to listen to the customer and combining those two elements to make an informed decision on which product to recommend, she notes.

Consultative sales can greatly benefit clients, Weitz maintains. If a pizzeria proprietor asks for an expensive $50,000 cash advance to buy a new oven, a responsible broker may find the applicant qualifies for an equipment loan with single-digit interest and monthly payments over a five-year period that puts less pressure on daily cash flow.

Consultative sales can greatly benefit clients, Weitz maintains. If a pizzeria proprietor asks for an expensive $50,000 cash advance to buy a new oven, a responsible broker may find the applicant qualifies for an equipment loan with single-digit interest and monthly payments over a five-year period that puts less pressure on daily cash flow.

It’s also about pointing out errors. Brokers and funders see common mistakes when they look at tax returns and financial records, says Brown. “The biggest issue is that small-business owners—because they work so hard— make a profit of X amount of money and then take that out of the business,” he notes. Instead, he advises reinvesting a portion of those funds so that they can build equity in the business and avoid the need to seek outside capital at high rates.

Another common error occurs when entrepreneurs take a short-term approach to their businesses instead of making longer-term plans, Brown says. That longer-term vision includes learning what it takes to improve their businesses enough to qualify for lower-cost financing.

Sometimes, small merchants also make the mistake of blending their personal finances and their business dealings. Some do it out of necessity because they’re launching an enterprise on their personal credit cards, and others act of ignorance. “They don’t necessarily know they’re doing something wrong,” Grayson observes. “There are tax ramifications.”

Some just don’t look at their businesses objectively. Take the example of a company that approached Central Funding for capital to buy inventory in Asia. Fiorella studied the numbers and then informed the merchant that it wasn’t a money problem—it was a margins problem. “You could sell three times what you’re wanting to buy, and you still won’t get to where you want to be,” he reports telling the potential customer.

Consultative selling also means establishing a long-term relationship. Forward Financing uses technology to keep in contact with clients regularly, not just when clients need capital, Bakes notes. That cultivates long-lasting relationships and shows the company cares. As the relationship matures it becomes easier to maintain because the customers want to talk to the company. “They’re running to pick up the phone.”

The conversations that don’t hinge on funding usually center on Forward Financing learning more about the customer’s business, says Solomon. That include the client’s needs and how they’ve used the capital they’ve received.

“We have our own internal cadence and guidelines for when we reach out and how often and what happens,” says Solomon. Customer relationship management technology provides triggers when it’s time for the sales team or the account-servicing team to contact clients by phone or email.

Do small-business owners take advice on their finances? Some need a steady infusion of capital at increasingly higher cost and simply won’t heed the best tips, says Solomon. “It’s certainly a mix,” he says. “Not everybody is going to listen.”

Paradoxically, the business owners most open to advice already have the best-run companies, says Fiorella. Those who are closed to counseling often need it the most, he declares.

Moreover, not everybody is taking the consultative approach. “New brokers are so excited to get a commission check they throw the consultative approach out the window,” Tibbs says.

Yet many alt-funders bring consultative experience from other professions into their work with providing funds to small business. Tibbs, for example, previously helped home buyers find the best mortgage.

Consultative selling came naturally to Central Funding because the company started as a business and analytics consultancy called Blue Sea Services and then transformed itself into an alternative funding firm, says Fiorella. Central Funding reviews clients’ financial statements and operations between rounds of funding, he notes.

Consultations with borrowers reach an especially deep level at PledgeCap, a Long Island-based asset-based lender, because clients who default have to forfeit the valuables they put up as collateral—anything from a yacht to a bulldozer—says Gene Ayzenberg, PledgeCap’s chief operating officer. Conversations cover the value of the assets and the risk of losing them as well as the reasons for seeking capital, he notes.

No matter how salespeople arrive at their belief in the consultative approach, they last much longer in the business than their competitors who are merely seeking a quick payoff, Tibbs says. Others contend that it’s clearly the best way to operate these days.

“The consultative approach is the only one that works,” says Weitz. “Today, everything is about the customer experience. People are making more-educated, better informed decisions.” What’s more, with the consultative approach clients just keep getting smarter, he adds.

The days of the hard sell have ended, Grayson agrees. Customers have access to information on the internet, and brokers and funders can prosper by helping customers, he says. “Our compensation doesn’t vary much depending upon which product we put a client in so we can dig deeper into what will fit the client without thinking about what the economic benefit will be to us.”

Even though the public has become familiar with alternative financing in general, most haven’t learned the nuances. That’s where consultative selling can help by outlining the differing products now available for businesses with nearly any type of credit-worthiness. “It’s for everybody,” Weitz says of today’s alternative small business funding, “not just a bank turn-down.”

Earn A Higher Commission On Your Deals With Us!... hello, smart business funding here. we're a direct funding company based in brooklyn, ny specializing in mcas and we're currently interested in buildi... |

Direct funder seeking new partners to work with!... hello, smart business funding here. we're a direct funder based in brooklyn, ny and we're currently interested in building relationships with new iso ... |

Direct funder seeking new partners to work with!... smart business funding here. we're a direct funder based in brooklyn, ny and we're currently interested in building relationships with new iso partners. we have a... |

See Post... smart business funding, direct number: (866) 737-6278, email: anthony@smartbusinessfunder.com, website: https://www.smartbusinessfunder.com/... |

Smart Business Funding- Inc 5000 List of Fastest Growing Companies in the USA... smart business funding, the leading financial services company in brooklyn new york is happy to announce that it is number 1229 on the annual inc. 5000 lis... |